This fine gentleman is Drew Hicken from Celtic Bank:

Drew has been a great advocate for us in our successful efforts to get financing. He's been responsive, helpful, and friendly — just the sort of person you want working for the bank that's funding your home. He helped finance the Lucy Avenue house (of Grassroots Modern blogging fame) and has built a nice residential niche in working with modern home owners and builders. (Plus, his hair is longer than Tai's, which bolsters Tai's argument that you CAN be a businessman with long hair.)

Thanks for all the hard work to this point, Drew, and here's a promise for that cost breakdown ASAP.

Monday, March 30, 2009

Friday, March 27, 2009

Thursday, March 26, 2009

Meet the architects

Introducing our architects: Kenner Kingston (left) and Matt Nelson of Architectural Nexus.

We're thrilled to be working with Kenner and Matt, who caught our eye for Architectural Nexus' work on the Lucy Avenue house (those owners were guest bloggers on Grassroots Modern during their building process, here, here, and here). Arch Nexus is large firm with offices here, Logan and Tempe, Ariz., and they've done a lot of institutional, medical and commercial work. Kenner, a LEED-accredited partner, worked on the eye-catching University of Utah Orthopaedic Hospital in Research Park.

This is a much smaller project than this firm would normally take on, so we're grateful that they are committed enough to the idea of a small, modern house in Salt Lake to spend their Thursday nights with us. (Also, big thanks to their understanding families for loaning them out on the night of the week's best TV.)

We spent Thursday evening going over the basics of how to layout our home (I can say that! We're really building it now!!). It was a really fun evening, spent answering questions such as, "How do you feel about doors?", "Does the kitchen need to be part of entertaining?", and "What do you expect out of your outdoor space?" It was great to be part of a guided discussion about the priorities for our home. At the end of the night, Kenner and Matt had sketched out a basic layout for the two floors.

Wednesday, March 25, 2009

Schedule

We are to close on our loan on Friday, midday. Once those signatures hit paper, this is roughly what our schedule looks like:

March/April: Design, starting with rough schematics running through final design

late April/May: final design, construction documents, engineering, bidding

May: permitting process begins with Salt Lake City

mid-June: possibility of beginning construction on footings and foundation

late June/early July: permits issued, construction begins in earnest

July through late December: construction

mid-January 2010: Construction loan comes due and we convert to permanent financing and move in...

Oh my...what a year!

March/April: Design, starting with rough schematics running through final design

late April/May: final design, construction documents, engineering, bidding

May: permitting process begins with Salt Lake City

mid-June: possibility of beginning construction on footings and foundation

late June/early July: permits issued, construction begins in earnest

July through late December: construction

mid-January 2010: Construction loan comes due and we convert to permanent financing and move in...

Oh my...what a year!

Monday, March 23, 2009

Essentials

We are moving quickly — we'll likely close on the lot at the end of this week, and we've already had a pre-design meeting with our architects. We'll have a standing meeting with them each week on Thursday, and we've already given them a short, basic list of our "must haves" for this place:

• open floor plan on first floor, combining kitchen, dining and living rooms

• radiant heating

• open floor plan on first floor, combining kitchen, dining and living rooms

• radiant heating

• designated space for an office

• 2 1/2 bathrooms (1/2 bath on first floor)

• three bedrooms: one master, two smaller

• alley-access parking

• lots of natural light

• as green as we can afford to be

What are we missing? Or, what would be on your list?

Friday, March 20, 2009

Financing

Our loan went for final approval before the loan committee at our bank yesterday. Things went very well and our loan was approved and stamped. We were very excited.

Initially we thought that we would first have to buy the lot with a lot loan and then refinance that loan later into a construction loan once we had plans and a cost breakdown. The bank decided that it would just be easiest to just do a construction loan now with the lot being our first draw on the loan. This should save us a significant amount of money in loan origination fees. We will go in with our equity injection next week and close on the construction loan at the same time that we are closing on the lot.

Since the bank usually doesn't fund construction loans without a cost breakdown we had to back our way into the numbers. The way we have approached this is that we have a certain amount of cash to inject into the project, so if we consider that amount at 20% of the total value, that tells us how much the total project can cost. We don't want a loan greater than 80% and on new construction a bank generally won't lend more than 80% anyway. This is especially true in the current economic climate. Our loan officer has been great and has really been proactive in getting this approved.

The first step was to get us approved for the permanent financing at the end of construction since it would make little sense to build a house and then not qualify to buy the house you just built. An extra challenge for us is that we own the condo we are currently in and we had to qualify for the final loan with our current mortgage payments part of the debt to income ratio. Otherwise we would have had to scramble to either sell or lease our condo before they would close on our permanent financing. Not knowing how the housing market will be 10 months from now, it could have been pretty stress inducing. So, this made it pretty tight on our debt to income ratio, but we did ultimately get qualified. Our condo will most likely be for sale though as we near completion of the house.

Once we were qualified for the permanent we were able to start working on the construction financing. Again, we don't have plans or a cost breakdown yet, but knowing what we are qualified for on the permanent financing lets us back into a number that defines our budget. This number will be our guide as we move towards designing the home. We are okay with this because we have talked with contractors and architects who think our budget is doable, even if it will be tight. With smart planning and a bit of sweat equity we should be able to pull it off.

These charts show roughly how the money is allocated in the budget:

Overall Construction Budget:

Breakdown of Soft Costs:

One thing that helped our loan sail through approval is the neighborhood we will be in. It is close to some really great neighborhoods that have high home values and the initial appraisal showed that we should not have any problems getting a good value on the home for the permanent financing.

So, anyway we have financing in place and we are excited to get moving on the design process.

Initially we thought that we would first have to buy the lot with a lot loan and then refinance that loan later into a construction loan once we had plans and a cost breakdown. The bank decided that it would just be easiest to just do a construction loan now with the lot being our first draw on the loan. This should save us a significant amount of money in loan origination fees. We will go in with our equity injection next week and close on the construction loan at the same time that we are closing on the lot.

Since the bank usually doesn't fund construction loans without a cost breakdown we had to back our way into the numbers. The way we have approached this is that we have a certain amount of cash to inject into the project, so if we consider that amount at 20% of the total value, that tells us how much the total project can cost. We don't want a loan greater than 80% and on new construction a bank generally won't lend more than 80% anyway. This is especially true in the current economic climate. Our loan officer has been great and has really been proactive in getting this approved.

The first step was to get us approved for the permanent financing at the end of construction since it would make little sense to build a house and then not qualify to buy the house you just built. An extra challenge for us is that we own the condo we are currently in and we had to qualify for the final loan with our current mortgage payments part of the debt to income ratio. Otherwise we would have had to scramble to either sell or lease our condo before they would close on our permanent financing. Not knowing how the housing market will be 10 months from now, it could have been pretty stress inducing. So, this made it pretty tight on our debt to income ratio, but we did ultimately get qualified. Our condo will most likely be for sale though as we near completion of the house.

Once we were qualified for the permanent we were able to start working on the construction financing. Again, we don't have plans or a cost breakdown yet, but knowing what we are qualified for on the permanent financing lets us back into a number that defines our budget. This number will be our guide as we move towards designing the home. We are okay with this because we have talked with contractors and architects who think our budget is doable, even if it will be tight. With smart planning and a bit of sweat equity we should be able to pull it off.

These charts show roughly how the money is allocated in the budget:

Overall Construction Budget:

Breakdown of Soft Costs:

One thing that helped our loan sail through approval is the neighborhood we will be in. It is close to some really great neighborhoods that have high home values and the initial appraisal showed that we should not have any problems getting a good value on the home for the permanent financing.

So, anyway we have financing in place and we are excited to get moving on the design process.

Tuesday, March 17, 2009

The land down under

We're back from Australia and basking in the memories of that very cool place. Friendly people, amazing beaches, beautiful city, and lots of modern homes. We didn't do any tours or seek out houses that fit our aesthetic down there. But the thing about Sydney is that modern architecture is everywhere -- it certainly seemed to be a more accepted and desirable style than in Salt Lake City (understatement? check!).

These houses are a few that we ran across while looking for other things. They aren't necessarily the best examples of the work down there (Dwell thinks that it has those covered in its March issue), nor are they necessarily exactly what works for us, especially in this climate. But, wow, aren't they cool?

This one was a public building at a beach in a national park about a half-hour south of Sydney:

This one backed onto a beach just north of Sydney. While we were enjoying the beach, a professional photography crew came to get styled shots of the interiors and rear of the house.

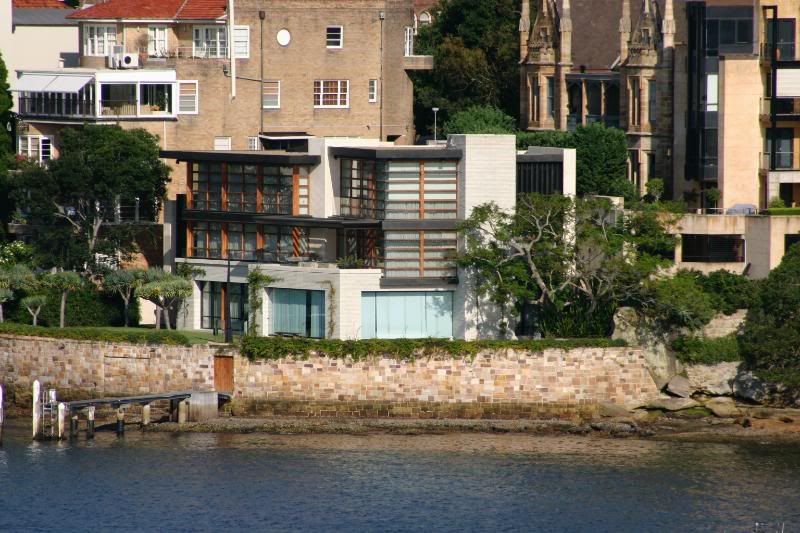

This was right across the bay from where we were staying (Thanks, telephoto!):

This one had gorgeous landscaping:

And this is how a pitched-roof can look cool:

Sigh.